By Loren B. Belker

A revolutionary proposal to simplify taxes by replacing the income tax with a retail sales tax, eliminating the IRS and transforming America's tax system.

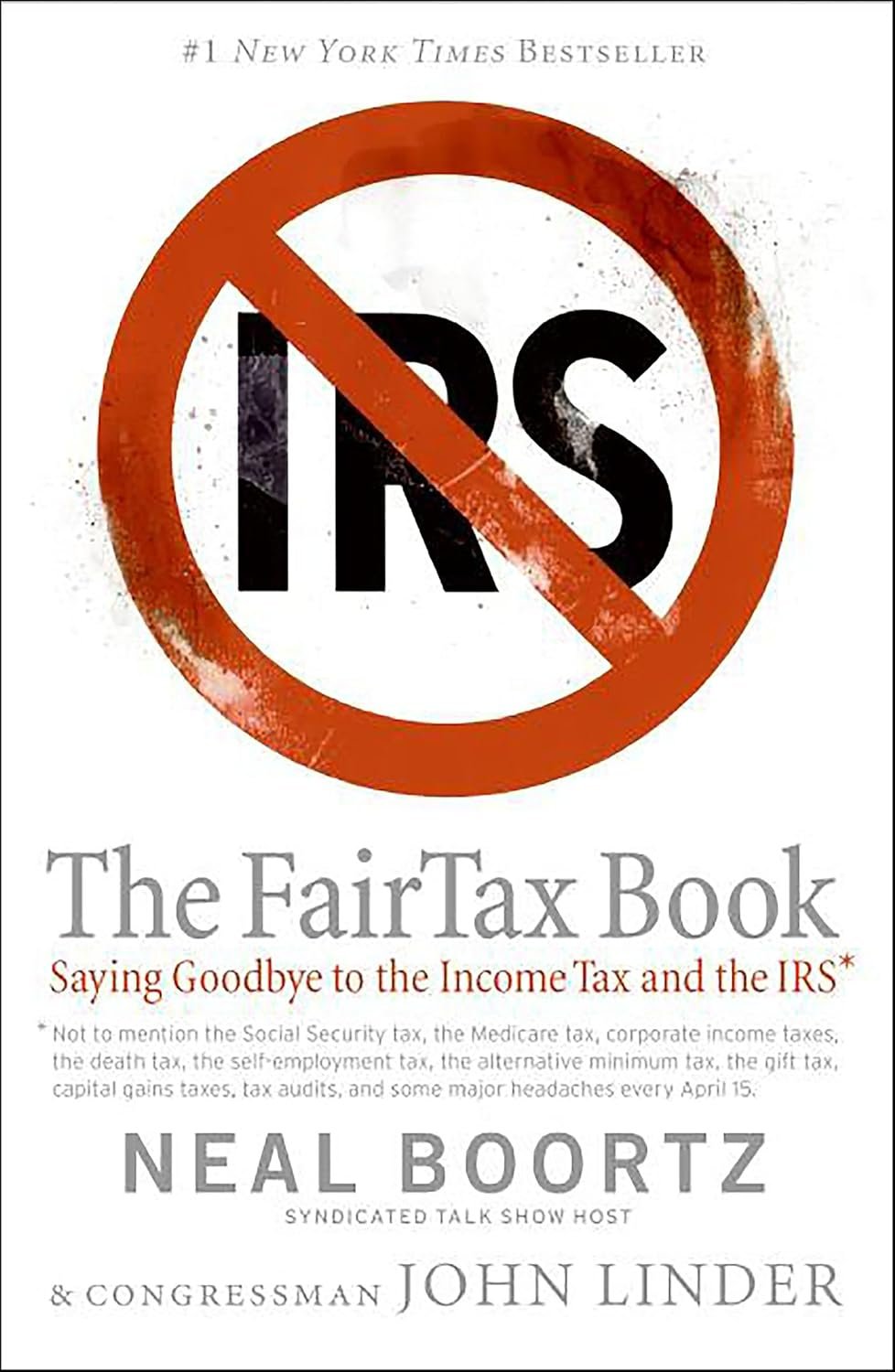

The Fair Tax Book: A Revolutionary Approach to Tax Reform

In "The Fair Tax Book," author Loren B. Belker presents a groundbreaking proposal that could transform the American taxation system as we know it. This #1 New York Times bestseller introduces a revolutionary concept: replacing the federal income tax with a straightforward 23 percent retail sales tax, effectively eliminating the need for the IRS.

Who Should Read This Book?

- Taxpayers frustrated with the current complex tax system

- Business owners and entrepreneurs looking to understand tax reform

- Policy makers and economists interested in alternative tax solutions

- Activists and citizens concerned about tax equity and transparency

- Anyone seeking to understand potential solutions to America's tax challenges

What You'll Learn

Reading this comprehensive 204-page guide will provide you with:

- A detailed understanding of the FairTax Plan and its implementation

- How a 23% retail sales tax could replace the current income tax system

- The benefits of keeping your entire paycheck without federal withholdings

- Ways the new system could eliminate tax fraud and reduce bureaucracy

- The economic implications of transitioning to a consumption-based tax system

How This Book Will Help You

The Fair Tax Book provides valuable insights in several key areas:

Financial Understanding

Learn how the proposed tax system would affect your personal finances and purchasing decisions.

Tax Planning

Understand potential future changes in taxation and how to prepare for them.

Economic Literacy

Gain deeper knowledge of how tax systems impact the broader economy and society.

Political Awareness

Better understand the ongoing debate about tax reform and its various proposed solutions.

Conclusion

The Fair Tax Book isn't just another commentary on tax policy; it's a bold proposal for fundamental change in how America funds its government. Whether you agree with its proposals or not, this book provides valuable insights into the possibilities for tax reform and the potential for a simpler, more transparent system.

With its clear explanations and compelling arguments, supported by leading economists and a growing grassroots movement, this book serves as an essential resource for anyone interested in tax reform or seeking to understand alternative approaches to national taxation. The ideas presented could revolutionize how Americans think about and pay their taxes, making it a must-read for those concerned about the future of fiscal policy in the United States.

Want Your Next Book Free

Get your next read free in your inbox. Subscribe to our deal newsletter where we send you update when a bestselling popular book is free as a deal.